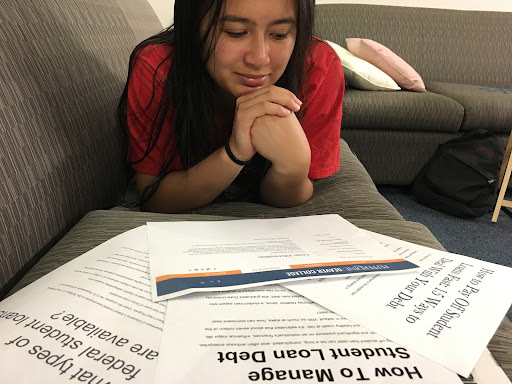

Sophomore transfer Kristin Vavaroutsos found herself saddled with $65,000 in student loans for her first year at University of Michigan.

That’s why she transferred to Pepperdine University, where she had earned a Regents’ Scholarship. A combination of the scholarship and her parent’s financial aid enabled her to attend debt free for her first semester.

The sports medicine major doesn’t think any college education is worth going into serious debt for.

“It made me realize that debt is like a real thing and now it’s influencing my choice of career for grad school because originally I wanted to be an athletic trainer but that doesn’t pay much,” Vavaroutsos said. “So instead I’ll probably go to grad school for like physical therapy.”

A Pepp Post survey of 52 students found that only 12 students, or 23 percent, agree with Vavaroutsos, though more than 40 percent weren’t sure. In interviews, faculty and students at agreed that college debt is good debt.

Pepperdine debt

On-campus undergraduate tuition, room and board and additional fees for the 2018-2019 academic year is $73,040, according to Pepperdine University Seaver College website, Grants, scholarships and student loans help students cover the costs.

Janet Lockhart, director of Financial Assistance, wrote in an email that the average student receives approximately $26,700 in grants and scholarships from the school each year. To cover additional costs, the average student borrows $6,700 in student loans. The rest comes from other sources, usually the parents.

Pepperdine’s Class of 2018 averaged $32,000 in debt at graduation, Lockhart wrote. In comparison, the average American college student graduates with $37,172 in debt, Josh Mitchell wrote in a May 2016 Wall Street Journal article.

“The decision to attend Pepperdine is an investment in a quality education and is one of the most important decisions a family will make,” Janet Lockhart wrote in an email. “An education is an investment in yourself, your career and your financial future that will last a lifetime.”

The amount of debt a student takes on hinders future career and education decisions.

Vavaroutsos has to decide between attending an affordable graduate school, or not going to graduate school at all, even though her major requires her to in order to gain a successful position in the industry.

“The loans made me realize I need to earn more money,” Vavaroutsos said. “It’s not solely because of the loans but they influence the decision.”

Lockhart wrote that because the average Pepperdine student graduates with less debt and good job opportunities, Pepperdine graduates are able to repay their loans more than the national average.

“Our three-year FY15 federal loan default rate is 2.5 percent compared to the National Average of 10.8 percent,” Lockhart wrote in an email. “Our students are borrowing at a manageable rate, graduating timely and succeeding academically.”

Tackling loans

For some, financial aid from parents is not an option. For most students, it boils down to their financial aid package that Pepperdine University sends out before the enrollment deadline.

Communication Professor Jennifer Akamine-Phillips attended Pepperdine University for her undergraduate degree. She is a first-generation college student and did not receive any financial help from her parents.

She took out her first loan during sophomore year to study abroad in Heidelberg, Germany. And then additional loans during her junior and senior year. She believes her Pepperdine education was worth taking out loans for.

“I think that I thought that if I’m just gonna take out this small loan at the time that it would be fine and I wouldn’t have to worry much about it,” Phillips said.

Now, she understands the financial responsibility of a loan. She said she did not educate herself on the full ramifications. Phillips studied communication and minored in violin performance because of the various opportunities for scholarships the program awarded her. The university’s offer of financial aid was what helped her decide to enroll.

Though she graduated with an undergraduate degree and debt of $20,000, most of her loans did not come until graduate school.

Phillips said her debt limited her ability to pursue different opportunities. One thing she would have liked to do was travel to another country to teach English but her financial responsibilities took precedent.

“I could never not have a job because every single month I’m still gonna have that payment that I’ll have to do and they’ll continue to pile up,” Phillips said.

Phillips has been deferring her loan payments, which will be approximately a quarter of her paycheck.

“I’m at a place now where I have a lot of loans because of grad work and am told it’s gonna be worth it,” Phillips said. “But it’s definitely painful paying it off because it’s a lot.”

Just over half of students surveyed said they have taken out loans.

For the Fall 2018 incoming class of first-year students, around 60 percent borrowed loans, Lockhart wrote in an email.

Is there such thing as good debt?

Debt obligates a borrower to pay or repay someone or something. Debt is manifested from college tuition fees, buying a house or car, shopping sprees, and other investments or purchases.

The act of owing someone or something can have negative connotations. Some 44 million Americans hold nearly $1.5 trillion in debt, meaning about one in four Americans are paying off their loans, Abigail Hess wrote in a Feb. 15 CNBC article citing the Federal Reserve Bank of St. Louis’ economic research.

That is what makes good debt seem like an oxymoron.

Dean Baim, divisional dean of Business Administration, explained that good debt has the potential to reduce future expenses and appreciate in value. It is planned, and if done right, it is not irresponsible.

He considers loans for a college degree to be good debt.

“The student would be more comfortable if they didn’t have a $35,000 debt,” Baim said. “But I think it’s relatively easy to justify that in terms of what hopefully will be the better quality life that you’ll have because of that.”

The Pepp Post survey reported 40 percent of respondents have experienced or currently experience a financial burden from attending Pepperdine.

First-year Katelyn Romeike’s parents took out loans to pay for her first semester. The international business major’s reasons for attending was for the connections and opportunities Pepperdine provides students.

“It’s a lot of money and I know I’m gonna have to pay it back at some point,” Romeike said. “So, it’s definitely a weight on my shoulders.”

Is a Pepperdine degree really worth it?

Prospective students take into consideration specific factors of the university, such as the high four-year graduation rate of 74 percent, that 51 percent are employed on graduation day, that 96 percent of students participate in internships, student teaching, undergraduate research and there are over 112,000 in the Alumni Network, Lockhart wrote in an email.

Senior advertising major Courtney Jobe knows first hand the impact a Pepperdine degree has on the outside world. She believes a bachelor’s degree is the key to future success.

Jobe has received full financial support from her parents throughout attending Pepperdine.

“I do believe attending Pepperdine has some clout carried with that,” Jobe said. “People know that it’s a difficult school to get into. It’s academically rigorous, and well ranked.”

The poll found that 42 percent of students said they came to Pepperdine for the academic reputation, 20 percent because they received financial assistance, 7 percent reported location as a factor, and 7 percent said the Alumni connection and networking opportunities.

A degree may not always be about the academic rigor universities provide. It’s also a time where a student grows and learns about life.

“For that student,” Baim said, “I think a college education is gonna be worth more. It’s gonna be worth the investment, not only in money but in time. If you do it as a drive by, then I think you get less out of it. You grow less as an individual.”

For Juan Barajas, a sophomore double major in theater and political science, college is about more than academics and financial burdens.

“It’s an opportunity and learning experience I’m going through,” Barajas said. “It’s not necessarily just the degree or just the education but I am finding myself at Pepperdine.”

Barajas receives a scholarship that covers full tuition. However, he had to take out loans to afford the rest of the costs, including room and board. He does not experience the anxiety that other students experience with loans. Instead, he welcomes it.

“Although I’m taking out loans, I know I’ll be able to repay them later on in my life,” Barajas said. “I think everyone gets into debt at one point in their life. I’d rather be in debt over college than anything else.”

Vavaroutsos could not be more opposite.

“I don’t think any education is worth seriously going into a whole lot of debt for because I feel like no matter where you go to college, if you work hard for it and get a decent education, it doesn’t matter where you went,” Vavaroutsos said.

Baim believes students who choose a Pepperdine degree over a more affordable school know the sacrifices it takes to afford tuition.

“Economists go by behavior,” Baim said, “Not what people say, so if they’re still here, I guess they think it’s worth it, otherwise they would have transferred to Cal State Northridge or somewhere closer to home.”

Nicole Hudecek completed the reporting for this story under the supervision of Dr. Christina Littlefield and Dr. Theresa de los Santos in Jour 241 in fall 2018. Dr. Littlefield supervised the web story.